Work with an award-winning insurance software development company.

For over 20 years, DOOR3 has been a trusted insurance software development company, creating cutting edge digital products that drive innovation. In the process, we’ve revolutionized how companies operate, and empowered a diverse array of organizations to scale up their businesses to serve the growing needs of their consumers.

Our insurance software development company associates work tirelessly to develop enterprise-scale software built on the cutting edge technologies of our modern world. Our insurance software development services streamline critical business functions surrounding policy management, claims processing, and customer engagement, freeing up your time for other business improvements. With our expertise in modern technologies and commitment to excellence, DOOR3 is the ideal partner for any insurance company looking to optimize and modernize their operations.

Benefits of our insurance software development services

-

Enhanced customer experience

Increase user engagement with delightful, individualized experiences across your mobile platform. Our insurance software development services create products to give users seamless interactivity, predictive guidance, and self-service options, instilling satisfaction and fostering brand loyalty.

-

Streamlined operations

As an insurance software development company, we create solutions to streamline your insurance operations through automation, optimization, and alleviating administrative responsibilities. This adds to efficiency, improves productivity, and creates cost saving opportunities.

-

Dynamic policy pricing

Customize coverage packages based on user behavior and insights using data analytics and machine learning. By optimizing risk assessment, offering individualized premiums and other targeted offerings, you can reduce loss, increase retention, and lower the costs of acquisition.

-

Reduced customer churn

Preemptively engage with customers through predictive analytics by offering them needed recommendations for upgrades or renewals to their policy. Our insurance software solutions, based on deep analysis of historical data, provide invaluable insights to drive user engagement, instill loyalty, and minimize turnover.

-

Data-driven decision making

As an insurance software development company, we utilize our deep analytic and data management capabilities to produce actionable insights, comprehensive reporting, and predictive tools that leverage data to empower you to make the best decisions. Optimize the modeling of your risk mitigation, pricing, underwriting, and other critical processes.

-

Streamlined claims settlement

Custom insurance software that uses innovative technology based on expertise can expedite the claims settlement processes, ensuring you can make decisions quickly and accurately. By automating processes through intelligent algorithms, you can more efficiently process claims and reach settlements more quickly. This increases customer satisfaction, retention, and referrals.

-

Scalability and flexibility

Our insurance software development services create solutions that accommodate your business growth and evolving needs. Scalable means they grow with you, while remaining flexible to allow for adaptation to shifting market pressures. This also allows you to increase your offerings, seamlessly integrating emerging technologies.

-

Faster time-to-market

Our experienced team follows an Agile development approach, allowing for rapid iterations, quick feedback loops, and accelerated time-to-market. This enables you to seize new business opportunities, launch innovative insurance products, and stay ahead of competitors in a dynamic marketplace. This is one of the hallmarks of progressive insurance software development.

-

Automatic fraud detection

Implement algorithmic-based fraud detection that is constantly vigilant for suspicious activity. Automatically detect fraudulent claims and reduce mitigation costs. Our secured insurance software development practices mean your operations remain secure.

-

Mitigate litigation risk

Customizable algorithms can predict when a claim will lead to litigation, and you can receive alerts so you can formulate strategies to limit risk and avoid costly litigation.

-

Align compliance and regulation

DOOR3’s customized solutions fundamentally adhere to industry-specific regulations, keeping all operations compliant even as guidelines shift. By prioritizing security, governance, and privacy, we help you safeguard sensitive information and protect your business reputation.

-

Integration and connectivity

We understand the importance of seamless integration with other systems and third-party platforms in the insurance ecosystem. Our insurance software solutions are built to easily integrate with your existing infrastructure, enabling smooth data exchange, interoperability, and collaboration with external stakeholders.

-

Continued support and maintenance

Our commitment to your success goes beyond your normal insurance software development company. DOOR3 provides support and maintenance insurance software development services to ensure the continued performance, security, and scalability of your insurance software. Our insurance software development support team is available to parse emerging issues, patch in upgrades, and work on enhancements.

Why should DOOR3 be your insurance software development company choice?

-

DOOR3 is your ideal partner as an insurance software development company, because of our extensive experience and deep domain expertise. Throughout our over twenty years in business, we have successfully delivered projects for a diverse array of clients in the insurance sector. Our teams of highly skilled professionals possess a deep understanding of the intricacies of the insurance industry, including regulations, compliance, and best practices. This enables us to develop customized insurance software development solutions that align with your unique needs and optimize your operations.

As a cutting-edge insurance software development company, we follow an Agile development approach, allowing for flexibility, transparency, and rapid, on-time delivery. We prioritize user experience, employing user-centric design principles to create intuitive, user-friendly interfaces that increase usability and customer satisfaction. This iterative process fosters continuous feedback and adaptation, delivering high-quality software within shorter development cycles.

Our quality assurance team conducts continuous comprehensive testing to ensure reliability, functionality, and security of your professional liability insurance software. Technical excellence is at the core of our services, as our team consists of highly skilled developers proficient in a wide range of technologies and frameworks. This allows us to be tech-agnostic and stay abreast with current industry trends and best practices, ensuring our solutions are innovative and technically robust.

Our approach is based on transparent collaboration and communication to keep you informed and involved at every stage of the project. We work closely with you throughout development, providing regular updates and seeking your feedback. This is the core of custom insurance software development services.

At DOOR3, client satisfaction is paramount. In order to exceed your expectations, we deliver projects on time and support your continued success into the future. Our commitment to client satisfaction is evident from our long-term partnerships and positive client testimonials.

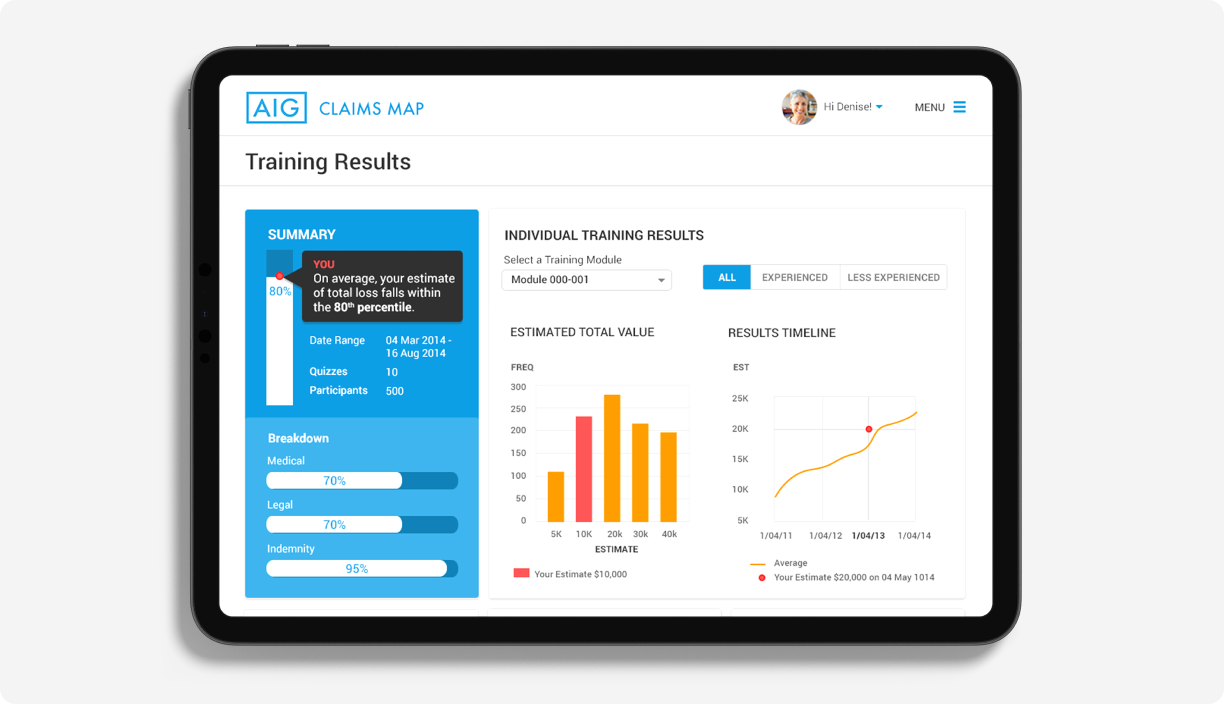

Achieving results: our successful insurance software development initiatives

We are proud to share the success stories from our insurance software development initiatives through these compelling case studies, which highlight how our expertise and innovative solutions transformed insurance operations and delivered tangible business outcomes.

“DOOR3 has a thorough understanding of how to design for enterprise insurance applications. They found the best solution and delivered it in a sensible timeframe. They helped our engineering team move faster. Together, we made the right design decisions and could subsequently defend them.”

Head of Product,

Health Insurance Software Company

Five steps to DOOR3’s insurance software development services

-

1

Requirement gathering

Before any software development for insurance happens, we first gather detailed requirements. DOOR3’s insurance software development team collaborates with you to understand your unique needs, goals, and the target audience for your product. These in depth consultations produce analyses built on a comprehensive understanding of the project scope.

-

2

Solution design and architecture

After requirements gathering, our expert UX designers and solutions architects craft a comprehensive insurance software development solution including fundamental architecture and designs. We clarify the system’s structure, user workflows, data models, and integration points to better facilitate the development phase.

-

3

Development and coding

Our highly-skilled developers bring your solution to life, utilizing modern programming languages, frameworks, and technologies to build robust and scalable insurance software development solutions. We adhere to industry best practices and coding standards to deliver top-quality code through efficient development.

-

4

Development and coding

Our highly-skilled developers bring your solution to life, utilizing modern programming languages, frameworks, and technologies to build robust and scalable software solutions. We adhere to industry best practices and coding standards to deliver top-quality code through efficient development.

-

5

Quality assurance testing

As a top-rate insurance software development company, quality assurance is one of our main concerns. Our dedicated quality assurance team conducts thorough testing to identify and rectify any bugs, issues, or performance bottlenecks. We perform functional testing, system testing, and user acceptance testing to ensure the software meets the desired quality standards.

-

6

Deployment and support

After thoroughly testing the software, we deploy to the production environment. The team will work with you towards a smooth transition to production with supplementary documentation and training as needed. We also offer post-deployment support and maintenance insurance software development services to address any issues and provide ongoing technical assistance for your custom insurance software.

Our insurance software development & consulting solutions

-

Legacy systems upgrade

Migrating legacy systems from outdated to modern platforms is a critically needed upgrade for teams struggling with antiquated systems slowing down their operations.

- Improved performance and reliability

- Greater software scalability and flexibility

- Seamless integration capabilities with third-party services

-

Custom insurance software development

From gorgeous front-end sales portals to backend operation platforms, DOOR3 builds custom insurance software development solutions tailored around the exact needs of the business.

- Enhanced customer experience and satisfaction

- Interoperability between existing systems

- Tailored to meet specific business needs and goals

-

Insurtech consulting

Consult with Insurtech experts who can guide you in the development process from starting ideas to finish products.

- Cost savings through intelligent technology implementation

- Holistic approach to consulting with all elements of the business considered

- Gain a competitive advantage with strategic business analysis

-

Business intelligence solutions

Our expert team of insurance software developers specializes in developing and implementing advanced data visualization tools and analytic dashboards, enabling you to organize information and extract valuable insights to drive your business performance and efficiency

- Develop and implement data visualization tools and analytic dashboards to organize information and extract insights around business performance and efficiency.

- Utilize Power BI to platform your data for streamlined internal communication across the Microsoft ecosystem.

- Develop and design within the platform for coherent data translation and visual language consistency.

-

Business operations application development

Whether you need broker portals, first notice of loss platforms, or other insurance applications to support underwriters, actuaries, or brokers, our expert team can deliver the solutions you need.

We offer two flexible approaches to custom insurance software development:

- Create digital solutions that help run your business. Develop broker portals, first notice of loss platforms, and any insurance applications needed to support underwriters, actuaries, or brokers in their operational needs.

- Build insurance software development solutions on a previously existing third-party platform, or start from the ground up. Not sure which is better for your insurance business? We can guide you through the decision process.

-

Insurance client portals/applications

Develop intuitive and feature-rich insurance client portals and mobile applications that empower your customers with self-service capabilities.

- Develop cross-platform and hybrid mobile apps with insurance claim submission modules and client-centered self-service portals.

- Allow customers to control their insurance coverage, report & submit claims, make customer inquiries with interactive chatbots, enable premium payments, and manage insurance policies.

-

Design development for insightful solutions

Our design-driven approach delivers delightful and intuitive user experiences for the end users of your products.

- Transform complicated data sets into visualizations to illustrate clear insights into the health of your business.

- Work in tandem with project developers to ensure a user-friendly experience for end users of a product.

- Develop an insurance enterprise design system capable of growing with your business and providing consistent styling for your brand.

Trusted by top insurance companies across the globe

Key considerations for insurance software development

-

Understanding your business

- Thoroughly analyze your unique business requirements, objectives, and target audience.

- Tailor your custom insurance software development solution to meet your specific needs and strategic goals.

-

Scalability and flexibility

- Develop an insurance software development solution that can scale with your business and handle future growth.

- Ensure the software is flexible enough to adapt to evolving market demands and technological advancements.

-

Security and compliance

- Implement robust security measures to protect sensitive customer data.

- Ensure compliance with industry regulations and data protection standards.

-

Integration capabilities

- Enable seamless integration with other systems, such as CRM platforms and third-party APIs.

- Facilitate data exchange and interoperability to streamline insurance processes.

-

User experience (UX) design

- Prioritize a user-friendly and intuitive interface for effortless navigation.

- Focus on creating engaging experiences that facilitate key tasks such as claim submission and policy management.

Technology expertise: empowering your insurance solutions with cutting-edge technologies

As an emerging leader in health insurance software development, we pride ourselves on our strong technological expertise and ability to leverage the latest advancements to deliver innovative insurance software development solutions. Our team of skilled custom software development professionals specializes in a wide range of technologies, programming languages, and frameworks. Here are the key areas of our technology expertise:

Programming languages

- Java

- C#

- Python

JavaScript/TypeScript

- Ruby

- PHP

Web and mobile development

- HTML5, CSS3, and responsive web design

- Angular, React, and Vue.js for front-end development

- Node.js and Express.js for back-end development

- Swift and Kotlin for iOS and Android app development

Database technologies

- SQL databases (e.g., MySQL, PostgreSQL, Microsoft SQL Server)

- NoSQL databases (e.g., MongoDB, Cassandra, Redis)

Cloud computing

- Amazon Web Services (AWS), including EC2, S3, Lambda, and CloudFront

- Microsoft Azure

- Google Cloud Platform (GCP)

Artificial intelligence and machine learning

- Building intelligent algorithms and models for insurance data analysis and prediction

- Natural Language Processing (NLP) for text analysis and chatbot development

- Recommendation systems for personalized insurance offerings

- Fraud detection and anomaly detection using machine learning techniques

Blockchain and smart contracts

- Developing blockchain-based solutions for secure and transparent insurance transactions

- Implementing smart contracts for automated claims processing and policy management

Tailored solutions for diverse stakeholders in the insurance industries

-

Insurance SaaS providers

- Our dedicated team can easily add new functionality to your product, increasing revenue.

- Augment your own team with our developers, eliminating the expense of hiring, retaining, and replacing staff through outsourcing.

- Integrate top-notch technologies like AI and IoT to attract more customers.

- Address technical issues faster and perform software updates on schedule, ensuring the smooth operation of your product.

-

Insurance companies

- Automate routine processes and free up time for business development.

- Digitize processes that generate paperwork, reducing human error and saving costs.

- Serve more clients efficiently with up-to-date software solutions.

- Improve the stability and performance of your insurance software while adding extra functionality to meet evolving business needs.

-

Insurance consulting firms

- Gain a long-term technological partner that supports you in acquiring new clients, providing tech consulting, and custom financial & insurance software development.

- Avoid the need to hire internal developers, project managers, business analysts, designers, testers, and other tech staff, allowing you to focus on business development and client relationships.

-

Reinsurance companies

- Collaborate with our experienced software developers to enhance your reinsurance operations.

- Leverage advanced technologies to streamline risk assessment, underwriting, and claims management processes.

- Improve data analysis capabilities to make more informed decisions and optimize reinsurance strategies.

- Develop custom insurance software development solutions to meet the specific needs and complexities of reinsurance operations.

-

Insurance agencies and brokers

- Secured insurance software development for more efficient client management, policy administration, and seamless integration with carrier systems.

- Incorporate lead generation capabilities to help insurance agencies and brokers attract and capture potential leads.

- Seamless data exchange between insurance agencies, brokers, and carrier systems.

Integration capabilities: seamlessly connect your insurance systems

-

Payment gateway integration

- Utilize popular payment gateways, connected with your custom insurance software to enable secure and efficient payment processing.

- Integrating a smooth payment experience gives your customers the ability to make premium payments conveniently and securely.

-

CRM platform integration

- Integrate your custom insurance software with leading CRM platforms, such as Salesforce or HubSpot.

- Unify analytic views of customer data, streamline lead management, and enhance customer relationship management.

-

Data analytics tool integration

- Seamlessly integrate your insurance software with data analytics tools, such as Tableau or Power BI.

- Unlock valuable insights from your insurance data, enabling data-driven decision-making and predictive analytics.

-

Document management system integration

- Integrate your custom insurance software with document management systems, such as SharePoint or Google Drive.

- Streamline document storage, retrieval, and collaboration, ensuring secure and efficient document management.

-

Rating engine integration

- Integrate your insurance software with rating engines to automate and streamline the policy pricing and rating process.

- Ensure accurate and consistent premium calculations based on predefined business rules and underwriting guidelines.

-

Carrier and underwriting system integration

- Establish seamless connectivity between your insurance software and carrier or underwriting systems.

- Enable real-time data exchange, policy submission, and quote retrieval for efficient collaboration with external partners.

Data security and privacy: safeguarding your information

-

Compliance with industry standards

- Adhere to GDPR, HIPAA, and other relevant data protection regulations.

- Stay updated on the latest security standards and compliance requirements.

-

Secure infrastructure

- Utilize encrypted connections, firewalls, and intrusion detection systems.

- Conduct regular security audits to identify and address potential threats.

-

Access control and user permissions

- Implement strict access control mechanisms based on roles and permissions.

- Ensure that only authorized individuals have access to specific data and functionalities.

-

Data encryption

- Encrypt sensitive data in transit and at rest to provide an additional layer of protection.

- Implement strong encryption protocols to prevent unauthorized access.

-

Regular security assessments

- Conduct security assessments and penetration testing to identify vulnerabilities.

- Proactively address potential risks through comprehensive security audits.

-

Confidentiality agreements

- Sign confidentiality agreements with clients to establish a legal framework for data protection.

- Ensure the privacy and confidentiality of sensitive information

- Easier access to user feedback.

DOOR3 deliverables: exceptional insurance software development services

-

Customized software solutions

We develop bespoke insurance software development solutions that are designed to address your unique business requirements. Our experienced team works closely with you to understand your goals and deliver a solution that aligns perfectly with your vision.

-

User-centric design

We prioritize user experience (UX) design, ensuring that your custom insurance software is intuitive, engaging, and easy to navigate. Our UX designers employ industry best practices to create visually appealing interfaces that enhance user satisfaction and streamline workflows.

-

Robust functionality

Our focus is on delivering insurance software development solutions with robust functionality that supports your business processes and requirements. We implement features such as policy administration, claims management, underwriting support, document management, and reporting/analytics to empower your operations.

-

Seamless integration

We understand the importance of seamless integration with existing systems and third-party applications. Our experts have extensive experience in integrating insurance software development solutions with CRM platforms, payment gateways, data analytics tools, and other essential components of your technology ecosystem. Choosing us for your insurance software development services needs means your software will be connected where it counts, when it counts.

-

Scalability and future-readiness

Our insurance software development solutions are designed to be scalable, enabling your insurance software to adapt and grow alongside your business. We incorporate future-readiness into our development process, ensuring that your solution can easily accommodate emerging technologies and evolving customer demands.

-

Quality assurance and testing

Rigorous testing is an integral part of our financial & insurance software development process. We conduct comprehensive quality assurance testing to identify and resolve any issues or bugs before deployment. Our meticulous approach ensures that your insurance software meets the highest standards of performance, security, and reliability.

Meet our team of experienced consultants specializing in insurance software development

At DOOR3, we take pride in our team of highly skilled and experienced consultants who specialize in insurance software development. With their deep understanding of the insurance industry and technical expertise, our consultants are dedicated to delivering innovative insurance software development solutions tailored to your specific needs.

-

Michael Montecuollo

Director of Principal Consulting

-

Alex Asianov

Founder & President

Quick facts about DOOR3

When it comes to choosing DOOR3 as your trusted insurance software development partner, our numbers speak for themselves.

+

years in business

+

successful projects

+

driven and talented professionals

Your questions answered

What do your insurance software development services include?

This is entirely dependent on the needs of our client, but our capabilities are far reaching. From building enterprise-level systems from the ground up to modernizing existing platforms, DOOR3 can provide a variety of services to meet your needs.

How long does it take to build custom insurance software?

Before we engage in design and development for a bespoke insurance software, we encourage our clients to participate in a technical discovery. During this process we explore exactly what the needs of the business are and the best approach to implementation, where we can develop a precise estimate for timeline and budget.

What is the price for a custom insurance solution?

There is no way to provide an estimation of price without first understanding the needs of the client. As a cutting-edge insurance software development company, project costs can range from tens of thousands to millions of dollars depending on the scale, but our minimum engagement costs sit around $25k.

How do you ensure data security and privacy in insurance software development?

Data security and privacy are paramount in insurance software development. We implement robust security measures, including encryption, access controls, and compliance with industry standards. We follow best practices in our software development for insurance to protect sensitive customer data and ensure confidentiality.

Can you integrate insurance software with third-party systems?

Yes, we have expertise in integrating insurance software with various third-party systems, such as payment gateways, CRM platforms, and data analytics tools. We ensure seamless data exchange and interoperability to streamline your insurance processes.

How do you ensure the quality of your software solutions?

We have a rigorous quality assurance process in place. Our team conducts thorough testing, including functional testing, performance testing, and security testing, to ensure the reliability and performance of our software solutions.

Do you provide ongoing support and maintenance for insurance software?

Yes, we offer ongoing support and maintenance services to ensure the smooth operation of your insurance software. We provide timely updates, bug fixes, and technical assistance to address any issues that may arise.

How long does it take to develop insurance software?

The timeline for insurance agency software development varies depending on the complexity and scope of the project. As an agile insurance software development company, we work closely with our clients to define realistic timelines and ensure efficient project delivery without compromising on quality.

Can you work with our existing technology infrastructure?

Absolutely. We have experience working with diverse technology environments and can seamlessly integrate our insurance software solutions with your existing infrastructure. Our team will collaborate with your IT team to ensure compatibility and smooth implementation.

What to consider in an insurance software development company?

When considering an insurance software development company, there are several factors to keep in mind. Here are some key considerations:

Expertise and Experience: Assess the company’s expertise and experience in insurance software development. Look for a company that has a proven track record in delivering successful projects and has experience working with insurance companies or related industries.

Domain Knowledge: Evaluate the insurance software development company’s understanding of the insurance industry and its specific needs. A deep understanding of insurance processes, regulations, and business requirements is crucial for developing effective software solutions.

Technology Stack: Consider the technologies, programming languages, and frameworks the company specializes in. Ensure that their technology stack aligns with your requirements and supports modern technologies, such as cloud computing, AI, or blockchain, to future-proof your software.

Customization and Scalability: Determine if the insurance software development company is able to develop customized solutions tailored to your specific needs. Look for an insurance software development company that can scale the software as your business grows or as your requirements evolve over time.

Security and Compliance: Data security and compliance are paramount in the insurance industry. Ensure that the insurance software development company follows best practices for data protection, encryption, access controls, and compliance with industry regulations like HIPAA or GDPR.

Quality Assurance: Assess the company’s quality assurance processes and methodologies to ensure that the software undergoes thorough testing and meets high-quality standards. Look for certifications or accreditations that demonstrate their commitment to quality.

Communication and Collaboration: Effective communication and collaboration are vital for a successful partnership. Evaluate the insurance software development company’s communication channels, project management methodologies, and transparency in sharing project updates and progress.

References and Reviews: Seek references or read client testimonials and reviews to gauge the reputation of the insurance software development company and their client satisfaction. Consider reaching out to their past or current clients to gather first hand feedback about their experiences.

Support and Maintenance: Inquire if the insurance software development company has post-development support and maintenance services. Ensure that they provide timely support, bug fixes, updates, and ongoing maintenance to keep the software running smoothly.

Cost and Value: Consider the cost of the insurance software development services offered by the company, but also assess the value they provide. Look for a balance between affordability and the quality of services delivered.

By carefully considering these factors, you can choose an insurance software development company that aligns with your specific needs, industry requirements, and long-term goals.

How do I get started with DOOR3 for insurance software development?

Getting started is easy. Simply reach out to us through our contact us directly. Our team will schedule a consultation to discuss your project requirements, provide an initial assessment, and guide you through the next steps.